Looking for ways to pay less taxes in Canada without getting in trouble with the CRA? You’re not alone. Each year, thousands of Canadians overpay their taxes simply because they don’t know about the deductions, credits, and strategies legally available to them.

In this tax-saving guide, we’ll break down the best, legal ways to reduce your taxable income, increase your refund, and keep more of your money. Whether you’re employed, self-employed, or investing, these tips will help.

What Is the Canadian Tax System?

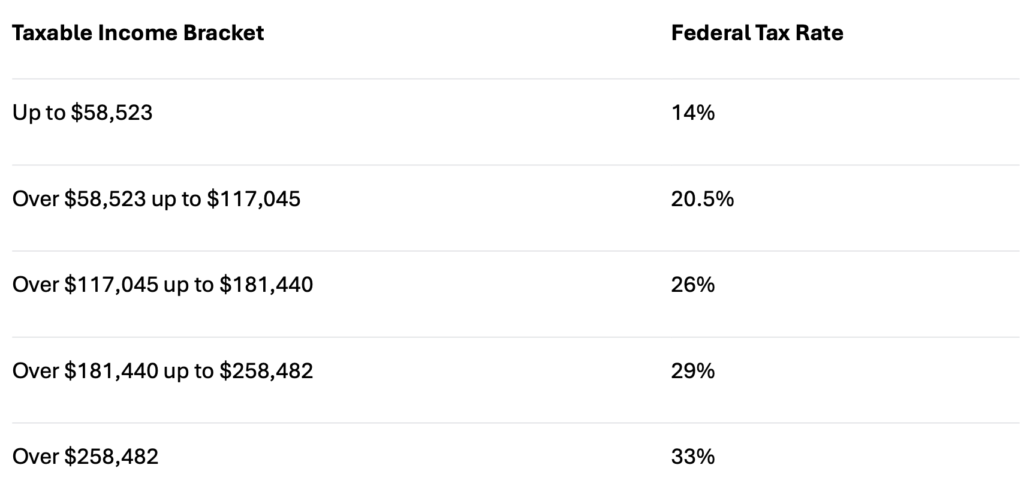

Canada uses a progressive tax system, which means the more you earn, the higher the rate at which the additional income is taxed — but not all your income is taxed at that higher rate.

Example:

If you earn $80,000/year, only the portion of your income that falls into each tax bracket is taxed at that bracket’s rate. Here’s a breakdown of the 2026 federal tax brackets:

This is called marginal tax rates, and it’s one of the most misunderstood parts of the Canadian tax system.

Why You Get a Tax Refund (or Owe Taxes)

- Work multiple jobs

- Have freelance income or side hustles

- Earn from investments Might increase your overall tax liability, potentially resulting in a balance owing at tax time — since they’re often not subject to tax withholding throughout the year.

Best Tax-Saving Accounts in Canada (2026)

Using registered accounts is one of the easiest ways to lower your taxable income in Canada.

1 – RRSP (Registered Retirement Savings Plan)

- Designed to help you save for retirement

- Contributions provide a tax deduction, lowering your taxable income

- Great for high earners or anyone with an employer RRSP-matching

Example:

If you earn $100,000 and contribute $10,000 to your RRSP, your taxable income becomes $90,000, potentially saving you around $2,000–$3,000 in taxes, depending on your province.

If your employer offers RRSP matching, this is essentially free money — take full advantage!

2 – FHSA (First Home Savings Account)

- For first-time homebuyers, need to respect the criteria as first-time homebuyers → Check if you qualify as a first-time homebuyer here

- Combines the best of RRSP and TFSA: tax-deductible contributions and tax-free withdrawals

- You can contribute up to $8,000 per year, to a lifetime max of $40,000

3 – TFSA (Tax-Free Savings Account)

Does not reduce taxable income, but allows your investments to grow and withdraw tax-free

Extremely flexible: Use for saving, investing, or emergency funds

Self-Employed? Claim These Tax Deductions in Canada

If you run a business, freelance, or work as a contractor, the CRA sees you as self-employed — and you gain access to valuable business deductions.

Common CRA-Approved Business Expenses:

- Laptop, camera, tools, and software

- Vehicle costs: fuel, insurance, repairs

- Home-office costs: mortgage interest + utilities

- Advertising, marketing, client meals

Example:

If your business earns $100,000 and you spend $20,000 on business expenses, your taxable income drops to $80,000.

If you’re unsure what qualifies, book a call with our tax team — we’ll help you structure and track everything properly.

Book your free consultation with TaxFlow hereCanadian Tax Deductions and Credits You Shouldn’t Miss

Here are the most useful Canadian tax credits and deductions:

- Childcare Expenses: Up to $8,000 per child (under age 7), up to $11,000 per child if they have a disability.

- Medical Expenses: You can claim them only if they exceed 3% of your net income. Choose any 12-month period ending in the tax year to maximize your claim.

- Donations Credit: Combine donations with your spouse and claim them under one person for a bigger credit. You get a higher credit rate once total donations exceed $200.

- Interest Deduction / Smith Maneuver: Convert personal debt (e.g., a mortgage) into tax- deductible investment. This advanced strategy requires proper planning but can yield significant tax benefits over time.

Income Splitting in Canada: Legal Ways to Do It

Income splitting is a powerful strategy for families with income differences. Here’s how to do it legally:

Pay a family member : (e.g., grandparents) for childcare and claim it as a deduction. In Quebec, make sure to issue a valid RL-24 slip in order for this to be accepted.

Spousal RRSPs: Higher-income spouse contributes, but lower-income spouse owns the plan. Withdrawals are taxed in the hands of the lower-income spouse later, creating tax deferral opportunities.

Spousal Loans: Shift investment income to a spouse in a lower tax bracket and write off interest at the prescribed rate per CRA. Needs proper planning beforehand.

Real Estate Tax Strategies for Canadians

Real estate can be a powerful wealth builder — and it comes with tax perks. Many Canadians consider real estate one of the most advantageous investments — especially when it comes to tax benefits, here’s why.

Principal Residence Exemption:

- Sell your primary residence tax-free — no capital gains tax applies

- Ensure your property meets all the criteria to qualify for the PRE

- Important: If you claim CCA (Capital Cost Allowance) on part of your home (e.g. home office or rental suite), you may disqualify this exemption

Rental Properties

Eligible rental expenses like:

- Property taxes, repairs / maintenance, insurance

- Mortgage interests

- Admin, travel

- Claim CCA (Capital Cost Allowance) to reduce taxable income — but plan carefully as this may result in recapture tax when selling

Always consult with a CPA when dealing with rental income reporting, CCA (Capital Cost Allowance) planning, or changes in property use — such as converting your home into a rental property.

Final Tip: Get the Basics Right First

- File on time

- Use registered accounts

- Keep track of receipts

- Don’t miss out on deductionsPaying less tax in Canada is not about cutting corners — it’s about using the tools the government already gives you. Whether you’re a student, salaried worker, self-employed, or an investor, there are smart strategies that can lower your tax bill and boost your refund.

Need Help with Tax Planning?

- Maximize your tax refund

- Legally lower your taxable income

- Plan smarter for retirement, investing, or buying a home

We’re here to help. Our partners at TaxFlow specialize in personalized tax strategies and real-world planning for individuals, families, and business owners.